It’s the time of year when we start seeing a lot of questions pop up around Social Security. This article from Tax Speaker does a great job of answering the most popular questions so we thought we would share it here. You can learn more about them here: https://taxspeaker.com/

1. At what age should I draw my benefit?

No one can give you a “one-answer fits all” response. There are three factors involved in this answer: genetics, personal health and financial need. Keep in mind that the Social Security Administration (SSA) tells us the average life expectancy for a male is roughly 84 years, and for a female 87 years in determining your answer, and then look at the age your parents (of your sex) died as a first measurement point. Then look to your own health because SSA tells us to knock ten years off of that life expectancy if you are diabetic, obese, smoke or have kidney disease. Finally, look at your financial need-do you really need the money or do you just want the money-there are severe, permanent penalties for drawing early, and substantial benefits for delaying. As a general rule I suggest delaying until age 70.

2. What are the age rules for drawing? (* means early draw penalty applies)

If drawing on your own benefit:

- If disabled at any age

- If not disabled, at age 62*

- As late as age 70

If drawing on a spouse (they must be drawing for you to draw on their benefit):

- As early as your own age 62*, if your spouse is drawing their own benefit

- As late as your own full retirement age, if your spouse is drawing their own benefit, note that delaying drawing a spousal benefit beyond your own full retirement age does not get you a dime more at age 70 versus age 67. We usually recommend spousal benefits be drawn when you reach your own full retirement age, which for most Americans is now age 67.

If drawing as a widow or widower on your deceased spouse

- Age 50 if you are disabled (deceased spouse must have been at least 62)

- Age 60* if you are not disabled (deceased spouse must have been at least 62)

- Full retirement age (usually 67 now). There is no reason to wait beyond this age-a widow/widower benefit does not increase beyond your own full retirement age.

If drawing as an ex-spouse (Your ex must be at least age 62 and you must have been married at least ten years)

- As early as your own age 62*, if your ex-spouse is at least 62

- As late as your own full retirement age, if your ex-spouse is at least 62 note that delaying drawing an ex-spousal benefit beyond your own full retirement age does not get you a dime more at age 70 versus age 67. We usually recommend ex-spousal benefits be drawn when you reach your own full retirement age, which for most Americans is now age 67.

3. How many years of working is my benefit based upon?

Your benefit is based on the average of your highest 35 years of earnings.

4. Can I increase my benefit with a couple of big years earnings?

Not significantly. Because your benefit is based on an average, and because any one year cannot be credited for more than the maximum wage limit for that year, one or two years of big earnings will have a negligible effect on your benefit because of the averaging. We generally say that you need at least 10-15 years of big earnings to have a significant effect on your benefit.

5. What is my full retirement age?

Your benefit is calculated on your full retirement age.

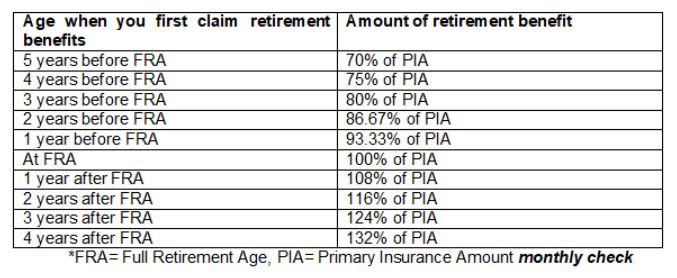

6. What are the penalties and rewards for signing up early (before full retirement age) or after my full retirement age?

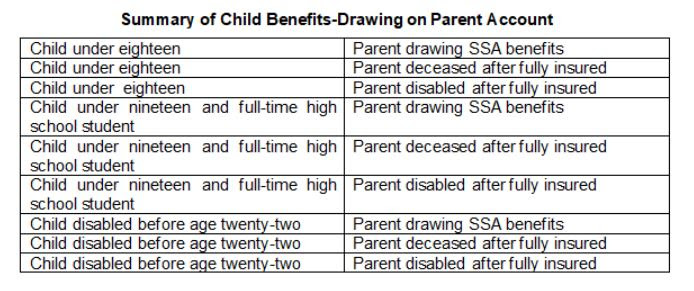

7. What kind of benefits does a child qualify for?

Normally a child qualifies for a benefit of 50% of a living parent’s benefit, or 75% of a deceased parent’s benefit. Here is a summary table:

8. What is the most common mistake made when drawing Social Security before full retirement age?

A combination of failing to recognize that you (and your spouse) cannot get Medicare before age 65 and the fact that the early signup penalty is the “forever” penalty that affects you and anyone drawing on your account for the rest of everyone’s life.

9. Is there an “ideal” amount of earnings to pay in if I am self employed to maximize my benefit in return for the tax I pay in?

There are things called “bend points” on which your social security is based. The ideal best “bang for your buck” of earnings vs. benefits is the top of the second bend point, which is about $72,000 for 2022.

10. Can I work while drawing?

Yes, but earnings are limited in the years before you reach your full retirement age if you sign up early. Once you hit your FRA, there are no limits on earnings.